Monthly recurring revenue (MRR)

It’s typical of a subscription-based business to have a continual influx of new customers and drop off of the existing customers, which leads to ongoing fluctuations in your revenue. To control this process, companies rely on such a metric as monthly recurring revenue (MRR).

What is MRR (monthly recurring revenue)?

MRR, or monthly recurring revenue, is the expected total income your business earns from all active subscriptions in a given month. MRR embraces recurring charges from discounts and recurring add-ons but excludes one-time fees.

Being one of the most important metrics for subscription-based businesses, MRR can help predict future company revenue.

How to calculate MRR

You can calculate MRR in a number of ways. Here are the most common MRR formulas:

Calculating MRR using customer-by-customer

This is a more thorough way of calculating MRR. It requires going through every single account and adding up their fees. You will know your exact base MRR this way.

Calculating MRR using ARPA (average revenue per account)

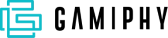

Calculating MRR using ARPA is a relatively simple equation. First, though, you must calculate ARPA, which requires setting a defined time period (usually a month, but sometimes a quarter or year) according to your billing options. The total revenue from all accounts during that determined time period divided by the number of accounts gives you the ARPA.

For example, if you have two accounts, one bringing in $100 and the other $300, the ARPA would be $200.

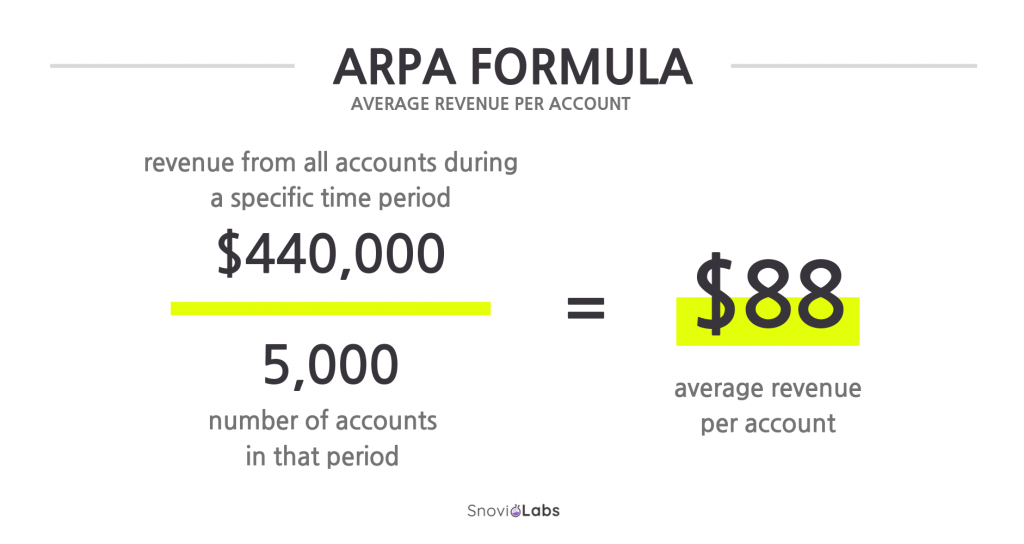

In order to calculate MRR, you multiple ARPA by the total number of accounts for the month. Using our previous example of an ARPA of $200 between 2 customers, the MRR would equal $400. It’s a quick and easy way to predict revenue, which is priceless for planning ahead.

You may want to have separate MRR calculations for existing and new customers in order to have a more complete and accurate prediction.

Other sections of MRR for calculating a comprehensive view of revenue

Calculating the MRR for existing accounts is great, but there is more to the picture than just existing accounts. In order to have a comprehensive and complete MRR report, calculate the following as well:

- New MRR – MRR from new accounts

- Reactivation MRR – A subcategory of New MRR from previous accounts who have come back to your service

- Expansion MRR – MRR from existing accounts upgrading to a higher pricing level

- Churned MRR – lost MRR from canceled accounts

Factoring in these specific MRRs will give you more exact results for what your overall MRR is. Some of these numbers (new, expansion, and reactivation MRRs) will show your growth, while the others (churned MRR) show revenue loss. Obviously, all are important in predicting future revenue streams, charting growth, preventing loss, and planning pricing. Possibly more importantly, they will help you determine why your revenue is going up, down, or staying the same.

Calculating Net MRR

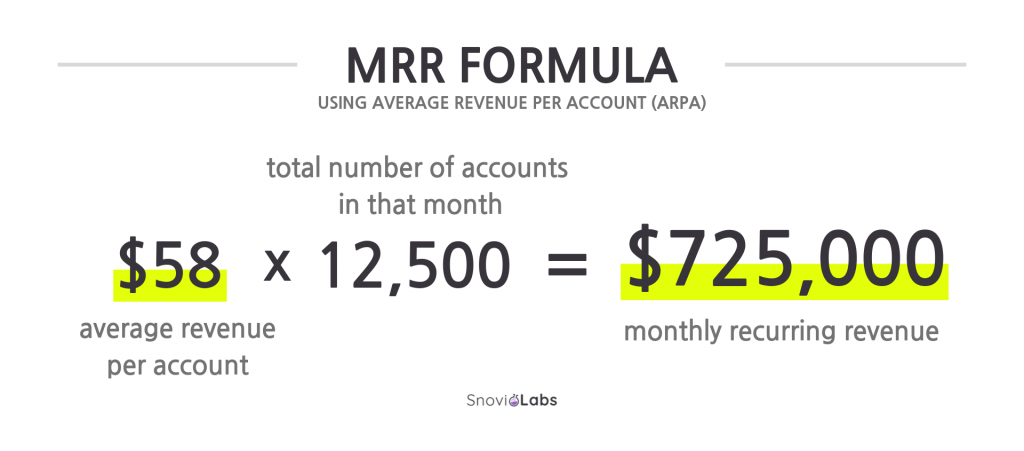

Again, this is a pretty simple equation. In order to calculate net MRR, you calculate:

Existing MRR + New MRR + Expansion MRR – Churn MRR = Net MRR

How to grow MRR

Generally speaking, you want your MMR to grow, not stay the same. There are several ways to go about upping your revenue:

- Increase in price

Do not make the mistake of underpricing your product. Consider it carefully; what does it actually do for your customer and what is that really worth? Find the sweet spot of what customers are willing to pay and what your product’s value is. - Upsells

Upselling to existing customers is a great way to boost revenue. Offering add-ons is an easy up-sell (“get this feature for only an extra $5 a month!”) and creating pricing-per-user packages is easy and quick. Giving people the option to buy more works. - No freemiums

Offering a limited-use free plan for your product does two things:

1. it literally makes your product limited, not showing potential clients everything it can do;

2. the consumer will make do with the limited plan and never buy the full version of the product.

The alternative to freemiums is limited free trials. Instead of offering a free way to use your product forever, let your potential customer try a full version of it for 30 days. Once they see how great and helpful it is, they will convert easier and your revenue will go up. - No unlimited plans

You sell yourself short if you offer an unlimited plan. Charge people for what they want to use – if they need an “unlimited” amount of whatever you’re offering, chances are they would be prepared to pay for everything they need anyway.

Why MRR is important

As we have noted before, knowing your gains and losses, and why you are having those gains and losses is important for predicting your revenue and charting your progress. The equations for calculating MRR and ARPA are simple (though some of them can be time-consuming), but they will give you a valuable insight you need to run your business right.

Comparing your MRRs month-to-month (or year-to-year, etc) can help analyze what areas your gains and losses are coming from and give you a chance to either build upon or fix those areas.

Being able to predict your revenue leads to educated planning and growth. The wise use of MRR data can help you find the perfect pricing that is a balance of your product’s worth and what the consumer is willing to pay, help determine the needs and pricings of add-ons, and help find the sweet spot for the free trial length that is most likely to lead to purchases.

In conclusion

MRR means little when taken alone. MRR is about trends and long term tracking of revenue and where it comes from (or is being lost from) in order to predict trends and future revenue, and see where there is a chance for revenue growth. Comparing past values to present ones shows you which direction your revenue is headed. MRR is a priceless tool that helps see both where you have been and where you are going.