Sales turnover

What is sales turnover? It is an accounting concept that determines how quickly a business conducts its operations. Most often, it is used to understand how much of its inventory a company sells within a defined period.

For example, if a business is selling mobile phones, the turnover rate would be the total amount of mobile phones sold in a year. It will represent the value of total sales provided to consumers during this time. Turnover is also used to calculate how quickly a company collects cash from accounts receivable.

Sales turnover vs. revenue

Sales turnover is often confused with revenue, and while these terms are related, they are two different measures used to determine the success of a company. While revenue measures the profitability of the business, turnover determines its efficiency. So, although sales turnover and revenue are not quite the same, they do often correlate, as companies earn more revenue by turning over their inventory frequently. And even though the turnover is not necessary to report, unlike revenue, it helps to understand how to manage production levels better.

Besides, we shouldn’t confuse sales turnover with the term “overall turnover,” which is a synonym for a company’s total revenues, most often used in Europe and Asia.

Two things to track: assets and ratios

Two of the most significant assets owned by a business are inventory and accounts receivable. And the most common measures of turnover rely on ratios involving these two things. Both assets require a heavy cash investment, and it is essential to calculate how quickly a business makes money.

Turnover ratios measure the efficiency with which a company generates revenue. They compare the dollar amount of sales or revenues to its total assets. Yes, this can get confusing, but stay with me!

Generally speaking, a higher turnover ratio = company is efficiently generating sales. A lower ratio = business is not using the assets efficiently, and there are some internal problems.

Sales turnover ratios vary depending on the sector, so you should only compare your ratios to companies within the same industry. These ratios are usually calculated on an annual basis, but it is quite common for it to be calculated quarterly too.

How to calculate the sales turnover ratio?

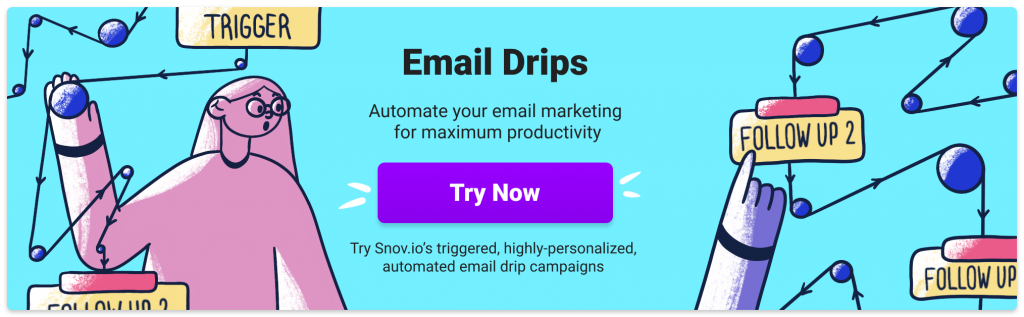

Accounts receivable turnover ratio

Now let us define the accounts receivable turnover ratio: it is an accounting measure used to quantify the company’s effectiveness in collecting its receivables or money owed by clients. This ratio shows how well a business manages the credit it extends to customers and how quickly this short-term debt is paid back. The equation to determine the accounts receivable turnover ratio is:

Accounts Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable

So, if you have credit sales for the month that total $400,000 and the account receivable balance is, for example, $60,000, the turnover rate is 6.7. The goal is to maximize sales, minimize the receivable balance, and generate a high turnover rate.

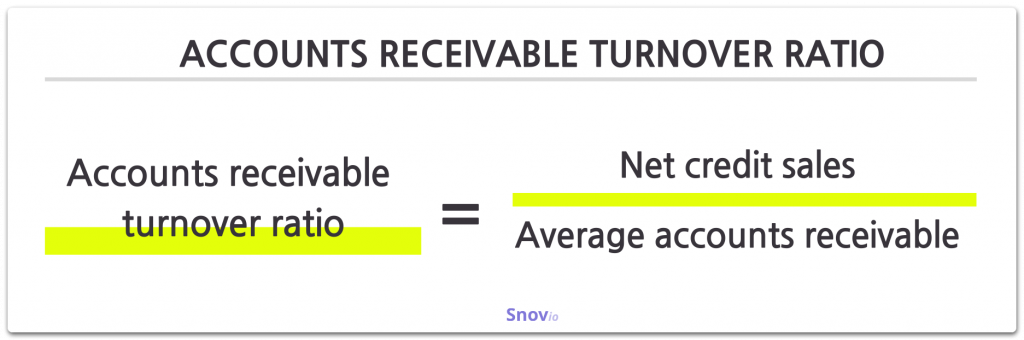

Inventory turnover ratio

Calculating inventory turnover can help companies make better decisions on pricing, manufacturing, marketing, and purchasing new inventory. The inventory turnover ratio formula is a little bit more complicated, but not by much. First, you have to calculate the cost of goods sold (COGS), which is: COGS = Beginning Inventory + Purchases during the period – Ending Inventory

After you have your COGS number, you can now calculate your inventory turnover ratio, which is:

Inventory Turnover Ratio = COGS / Average Inventory

For example, if your cost of goods sold is $500,000 and you have $150,000 in inventory, your inventory turn ratio is 3.3. Inventory turnover helps investors determine the level of risk they will face if providing operating capital to a company. So a business with a $7 million of inventory that takes eight months to sell will be considered less profitable than a company with a $3 million of inventory that is sold within three months.

Why is sales turnover so important when you can just look at revenue?

We are all here to make money, right? Yes, revenue is the top line, the big number that shows you how much money you have made, but sales turnover ratios show you how well you are doing at making that money.

If you are running a company that sells physical inventory like a clothing store or a grocery market, your sales turnover ratio will be much higher than say a car dealership’s, so it is important to take your industry into consideration when reviewing it. Comparing your sales turnover ratio to other companies within your field can help you find your sweet spot and determine what ratio to shoot for.

If you are a non-physical goods company, such as a SaaS or a service provider, you might want to use the accounts receivable turnover formula to learn how quickly you are collecting payments, and the goal is to maximize sales, minimize the accounts receivable balance, and generate a high turnover rate. Again, it is helpful to look at other businesses in your industry to get an idea of what kind of ratio you want to aim for.

Summing up

Technically, there is no intrinsic value to sales turnover – in other words, there is no exact number or scale you should aim for. Instead, you should use it as an indicator of your company’s performance in comparison to past performance and industry standards.

Yes, the higher the ratio, the better, but that does not mean every company’s “higher” will be the same. Your sales turnover ratio should be tracked to determine if a trend or pattern is emerging, as well as to see if there is any room for improvement in your assets or selling process, there is no arbitrary number you should be hitting.

Simply put, the turnover ratio is an indicator of the efficiency with which a company is using its assets to generate revenue. It is a way to keep a check on your success. The higher the turnover ratio, the more efficient a company is; and conversely, if a business has a low turnover ratio, it shows it is not efficiently using its assets to generate sales, and some changes need to be made.