Deferred revenue

If you have received revenue, it doesn’t necessarily mean it has already been earned. Often, you can deal with deferred revenue – something most SaaS subscription companies are familiar with.

What is deferred revenue?

Deferred revenue is also known as unearned revenue or deferred income, It’s payment received by a company in advance for services it has not yet provided or goods it has not yet delivered. This money has not been earned and thus can’t be reported on the income statement.

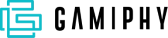

Is deferred revenue a liability?

Yes, deferred revenue is a liability and not an asset. The payment the company gets represents something owed to the customer.

Deferred revenue examples

All companies selling products or providing services that require prepayments deal with deferred revenue. Here are some examples:

- Advance rent

- Mobile service contracts

- Ticket selling

- Prepayment for an annual subscription to an online service

- Annual subscription to a SaaS company’s plan

Let’s dive deeper into the last example. Imagine that a business offers a yearly plan with monthly payments of $10. Their customers who decide to try it pay in advance for the subscription. This revenue will be deferred until clients receive a full year’s use of the service.

As soon as the goods or services are delivered or performed, the deferred revenue turns into the earned revenue. You can now move it from the balance sheet to the income statement.

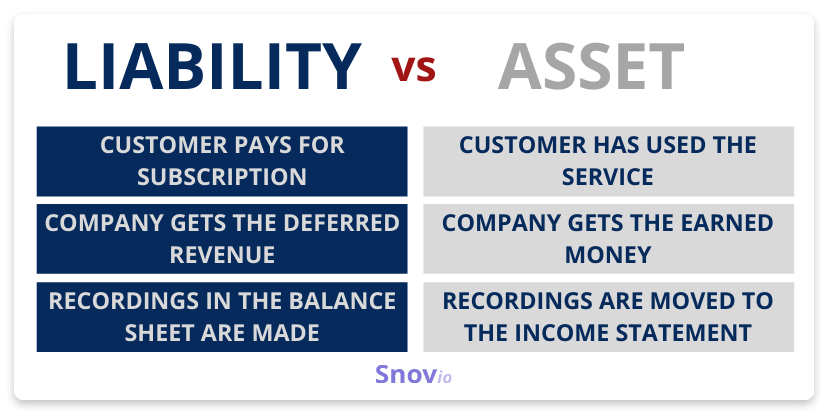

Deferred revenue vs. Accrued expense

Deferred revenue is often mixed with accrued expenses since both share some characteristics. For example, both are shown on a business’s balance sheet as current liabilities. The difference between the two terms is that deferred revenue refers to goods or services a company owes to its customers. Meanwhile, accrued expenses are the money a company is obliged to pay.

For instance, if a business buys tech supplies from another company but still has not received an invoice for the purchase, it records the accrued expense into the balance sheet. The same goes for employees’ salaries and bonuses accrued in the period they take place but paid in the following period.

Why is deferred revenue important?

In its broader sense, the deferred revenue is a strategy used in accrual accounting.

Accrual accounting is one of the two main contrasting ways (another is cash accounting) of approaching finances. In it, income and expenses are recorded as they occur, regardless of whether the cash has been received. According to the GAAP, all companies with more than $25 million in annual sales should use accrual accounting.

Deferred revenue helps apply the universal principle in accrual accounting — matching concept. It presupposes that businesses report (or literary match) revenues and their related expenses in the same accounting period. If companies report only revenues without stating all the expenses that brought them, they will deal with overstated profits.

Tips for deferred revenue accounting

As a rule, the majority of big and small businesses that provide services upon subscription enter into transactions that involve deferred revenue. Your company is most likely not an exception. To account for the deferred revenue, you need to:

Identify transactions that involve the deferred revenue

Step 1. Determine the reporting period

It can be a month, a quarter, or a year, depending on your company.

Step 2. Determine the realized customer orders

Identify the services or goods for which you have already received payment but which you should still deliver till the end of the reporting period. As you identify these transactions, it’s high time for your accountants to calculate and record the amount of the deferred payment.

Record the deferred revenue

Step 1. Fill in the balance sheet

The cash that the company receives should be recorded on the balance sheet as an asset account. Meanwhile, the deferred revenue must be reflected on the balance sheet as a liability account.

Let’s say, your business receives payment from the customer for the month of subscription to your service, which costs $40. You should record the entire amount as the deferred revenue. To do this, your accountants will make the following deferred revenue journal entry:

- Debit Cash $40

- Credit Deferred Revenue $40

Step 2. Record the earned revenue

At this stage, you will need to update the journal entry in the previous step by reducing the balance sheet liability and transferring the amount to the income statement.

For instance, your company offers the annual subscription to your service, which costs $360. After the first month of your client’s using it, you will earn $30 ($360 / 12) of revenue. Now, the deferred revenue amount will be $330 ($360 – $30). Your accountants will need to transfer $30 from the deferred revenue account to the earned revenue account using such a journal entry:

- Debit Deferred Revenue $30

- Credit Subscription Revenue $30

Step 3. Make records until all the revenue is earned

You should go on adjusting the balance sheet and income statement as long as you are providing the service until you have nothing to owe, so the liability to the customer reaches zero.

For example, when your customer’s annual subscription (let’s assume it’s the one mentioned above) comes to an end, your deferred revenue account will have a balance of $0, while your earned revenue altogether will equal $360.

Summing up

In accrual accounting, revenue is recognized as earned only when payment has been received from the customer, and the goods or services have been delivered to them. So, the deferred revenue is accrued if the client has paid for goods or services in advance, but the company is still to deliver them later.

Deferred revenue accounting is important for accurate reporting of assets and liabilities on a business’s balance sheet in accordance with the matching concept. Thereby, it prevents brands from overstating their profits.

Companies that provide service on a subscription basis should record the deferred revenue by adjusting their balance sheet and income statement till the end of the customer’s subscription, i.e. when their liability to the customer is nullified.