Return on investment (ROI)

What is ROI? It’s probably one of the most important metrics for businesses, which helps identify effective channels to attract and convert customers and understand the profitability of an investment.

ROI meaning

ROI, or return on investment, is a commonly used measurement of gain and loss generated on an investment relative to the amount of money invested. It is one of the profitability ratio formulas used in financial analysis for monitoring sales and profits within businesses.

ROI is most often presented as a percentage. The equations are relatively straightforward and simple, but ROI can be used beyond just a company’s total profitability calculation and it is often used within specific departments.

How to calculate ROI

There are several different ROI equations, all equally valid but used for different scenarios. Calculating your return on investment is pretty easy as long as you have the numbers ready.

Here are 4 of the most commonly used ROI calculation formulas.

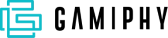

ROI formula #1: Net income method

The formula for Net Income ROI is pretty simple. All you need to know is your initial cost of investment and your final net return. Here’s how to calculate net income ROI:

ROI = (Net Return / Cost of Investment) x 100%

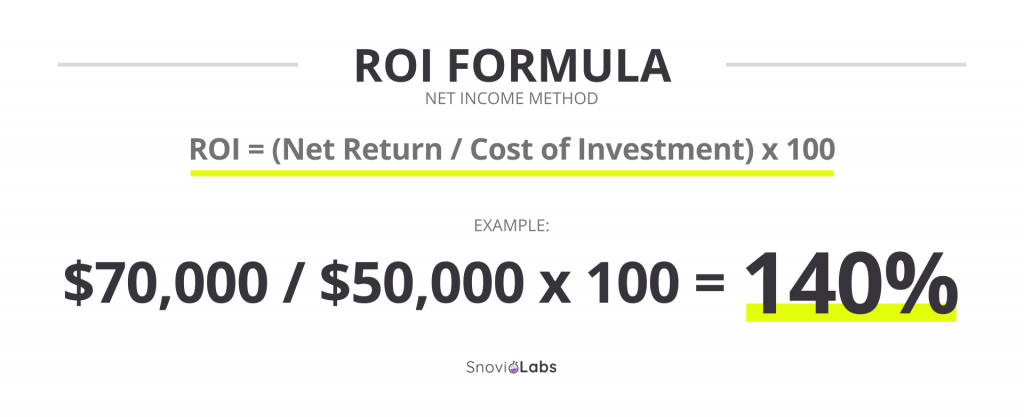

ROI formula #2: Capital gain method

ROI is typically calculated by taking the net profit of the investment, subtracting the total investment cost, then dividing it by the total investment cost. Multiplying this by 100 gives the ROI percentage:

ROI (%) = ((Net Profit – Investment Cost) / Investment Cost) x 100

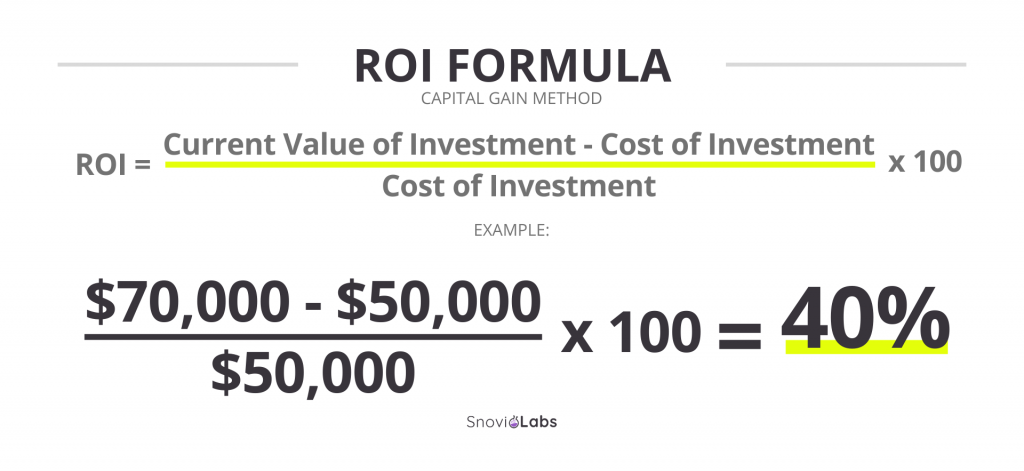

ROI formula #3: Total return method

Total return method helps calculate return on investment in shares:

ROI = ((Current Share Price + Total Dividends Received – Original Share Price) / Original Share Price) x 100%

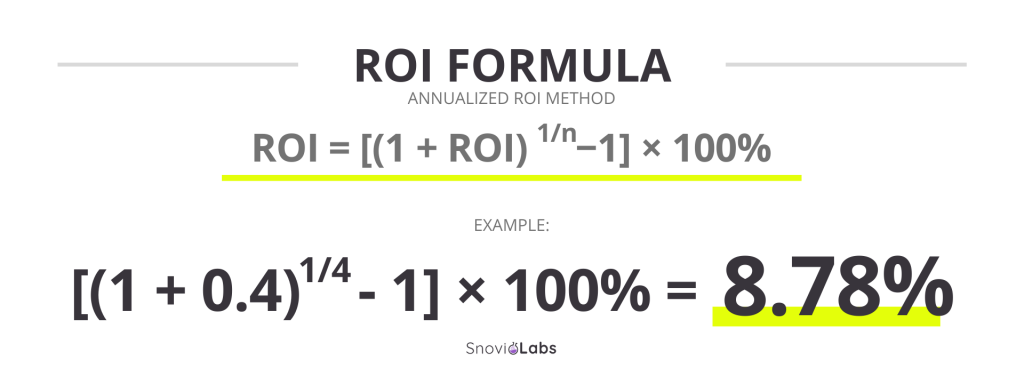

ROI formula #4: Annualized ROI method

This method allows to calculate ROI taking into account the time of investment. This formula is slightly more complicated than the others and to calculate ROI using it, you first need to calculate your capital gain ROI and know the number of years the investment is held for:

ROI = [((1+ capital gain ROI)^1/n)−1] × 100%

(Where n is the number of years the investment is held for)

ROI metrics can be as simple or complex as you want them to be. These formulas are very flexible and can be used in various ways. Anything that had an initial investment and a measurable current value of profit can have its ROI calculated.

Interpreting ROI

The ROI equations use “net return” instead of “net profit” because the returns from an investment can be and often are negative instead of positive. Just like balancing your checkbook, if your ROI is positive, you’re in the black, and your total returns exceeded your total costs. Having a negative ROI means you’re in the red, with your total returns being less than your total costs and your investment producing a loss.

So what is a “good” ROI? Well, that depends on your business and industry. If you are an investor, generally, 15% is considered good. For digital marketing, it is 118%. As you can see, there can be some drastic differences. You should not just shoot for a number you picked randomly, you need to know your industry’s standards and work from there, as an Overarching Good ROI Measurement™ does not exist.

Benefits and downsides of using ROI

ROI is the simplest measurement of the percentage of profit from an investment and has a lot of benefits:

- Easy to calculate

- Helps predict future potential returns

- Helps set goals for current and future projects and departments

- Understood by both experts and laymen alike

- Effective in measuring project success

- Can help in deciding between different investment opportunities, giving you plain numbers to help with decision making

- Can be used for calculating or comparing the returns from the past. (For example, if you are looking into investing in a project or a business, you can see how it performed in previous years, with ROI being the first metric to check)

In making investment decisions, ROI can play a big role, helping you know where to focus your investments and where not to for maximum revenue. For example, a negative ROI might call for a major change. However, you should always take into consideration what the average is in your industry to make sure you’re within a “good” range.

That said, ROI calculations have their downsides. One major downside to ROI calculations is in that, for the most part, time is not factored into them (except in the annualized return method), so you cannot see the impact of time on your numbers.

Also, the variety of ROI calculation methods can make it confusing: if a company calculates using one formula, an investor may calculate using a different one, which might result in different percentages, creating both a difference of opinion and confusion. Obviously, you do not want that to happen, so communication is key when crunching numbers – make sure everyone is using the same formula.

In conclusion

Knowing your return on investment gives you a big heads up in financial decision making on all levels of your business. ROI equations are a quick, simple, and easy-to-understand way to analyze your investments, determine the worth of your investments, and help you make financial decisions based on how well your business is truly performing.