Unicorn

What is a unicorn company? Unicorn is a word used in the venture funds industry to indicate a tech startup with a total market value of over $1 billion.

The name was first used and popularized by Aileen Lee, a venture entrepreneur and founder of CowboyVC – a seed-stage investment fund based in Palo Alto, California.

The logic and math behind the crucial $1 billion threshold

Why are stockholders crazy about “billion-dollar outcomes”? Because the largest investment funds have always driven revenues from their ownership in just several companies, only to invest them back into a pool of many new promising businesses.

Besides, traditional investment funds have expanded in size, demanding more substantial “exits” to produce satisfactory returns. For instance, to return the primary venture investment of $400 million, they might require to own 20% of two different $1 billion businesses, or 20% of a $2 billion business when the company is bought or goes public.

According to Aileen Lee, there’s a strong psychological difference in perception of a company when it reaches the unicorn status:

“One billion is better than $800 million because it’s the psychological threshold for potential customers, employees, and the press.”

Origins of the unicorn company meaning

Aileen Lee wanted to understand how probable it is to find and fund one of those promising startups, so in 2013 she conducted research and discovered that only 0.07% of venture-backed businesses were evaluated at more than $1 billion. Lee decided to share her conclusions, but she first had to invent a term that could accurately depict this class of companies.

Here’s the backstory in her own words:

“I was trying to come up with a word that would make it easier to use over and over again. I played with different words like ‘home run,’ ‘megahit,’ and they just all sounded kind of ‘blah.’ So I put in ‘unicorn’ because they are – these are very rare companies in the sense that there are thousands of startups in tech every year, and only a handful will wind up becoming a unicorn company. They’re really rare.”

The fact that the unicorn startup meaning itself is inspired by fiction genres, popular among techies – sci-fi and fantasy – has solidified its place in Silicon Valley business discussions.

Here’s what Robin Lakoff, professor of linguistics at the University of California, Berkeley, had to say about the term:

“In a way, the term romanticizes tech-companies: takes them from the remote and unintelligible to the magical and even lovable, while also being rare and powerful. I certainly would feel nicer toward megarich tech startups if I could think of them as unicornlike.”

Related terms: White Whale

Why unicorns are getting so widespread

Lee’s article wasn’t the only reason the name became so widespread. Over the past decade, two significant changes in the IT industry have created a need for a term that could quickly describe private billion-dollar tech companies.

That said, right now there’s no actual math to estimate startups – the valuations are most often based on a company’s business potential, and are merely approximate estimates. This has made it easier for startups to earn billion-dollar estimates.

The other significant change is that venture-supported businesses stay private much longer than in the previous decades. In 2000, the medial term of an initial public offering was 3.1 years, according to the National Venture Capital Association. That number doubled in 15 years, partially because numerous promising businesses want to benefit from the friendly estimating environment before they go public. Besides, the development of private markets has made it simple for unicorn stockholders to withdraw their investments without pushing their startups to go public and appear under the lens of Wall Street’s relentless eyes.

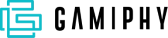

Merged, these two differences lead to the appearance of more unicorns than ever before. In 2018 alone, 16 new US businesses became unicorns and raised the total number of global private startups valued at $1 billion or more to 119.

List of current unicorns across the globe

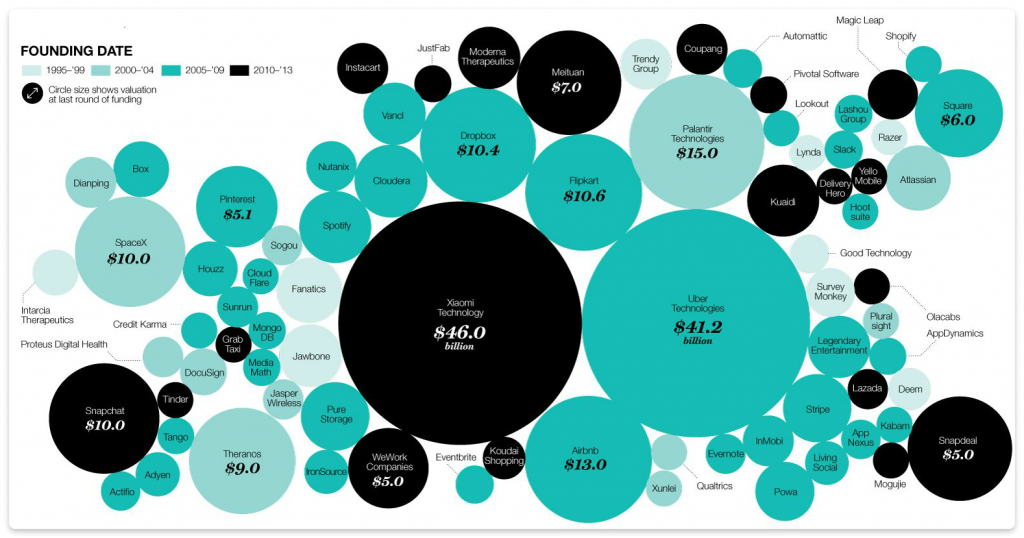

Far from being just imaginary animals, unicorns are a natural topic in current business and investment discussions. Some well-known U.S.-based unicorns are SpaceX, Uber, Palantir Technologies, Airbnb, Pinterest, and WeWork.

China appears to have a lot of unicorns as well, including Xiaomi, Didi Chuxing, Lu.com, and China Internet Plus Holding.

There are multiple lists of unicorn startup businesses available online, with notable lists compiled by Fortune Magazine, The Wall Street Journal, TechCrunch, CNNMoney/CB Insights and PitchBook/Morningstar.

Is there some other unicorn meaning in business?

Yes, “unicorn” can also refer to recruitment within the HR sector. HR executives may have high demands when trying to close a specific job position, leading them to look for specialists with skills that are more powerful than those usually required for the position. In other words, these recruiters are looking for a “unicorn”, which leads to a break between their perfect candidate versus the realistic pool of professionals available.

For instance, a medium-sized company may want to find and hire a person who has writing, sales, marketing, social media, and management expertise, as well as fluency in two foreign languages. Although it may pay off to hire one candidate with all those talents instead of several different employees to manage various tasks, it is also likely that all these duties and responsibilities will be difficult to cope with for a new employee, leading to frustration.